Hvac Useful Life Macrs . when do you recapture macrs depreciation? depreciation is the amount you can deduct annually to recover the cost or other basis of business property. Method for a macrs asset for which you're making the irrevocable election under code section. Additional rules for listed property. macrs sl class life method. heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses. The table specifies asset lives for. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the.

from seltz-bakalars.blogspot.com

Method for a macrs asset for which you're making the irrevocable election under code section. depreciation is the amount you can deduct annually to recover the cost or other basis of business property. macrs sl class life method. Additional rules for listed property. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. when do you recapture macrs depreciation? heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses. The table specifies asset lives for.

hvac equipment life expectancy chart seltzbakalars

Hvac Useful Life Macrs to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. macrs sl class life method. Method for a macrs asset for which you're making the irrevocable election under code section. depreciation is the amount you can deduct annually to recover the cost or other basis of business property. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. when do you recapture macrs depreciation? The table specifies asset lives for. heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses. Additional rules for listed property.

From www.thetrainingcenterofairconditioningandheating.com

Why HVAC Technicians are Heroes HVAC Career Training Center AC Hvac Useful Life Macrs to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. Method for a macrs asset for which you're making the irrevocable election under code section. heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses. Additional rules for listed property. depreciation is. Hvac Useful Life Macrs.

From www.pmengineer.com

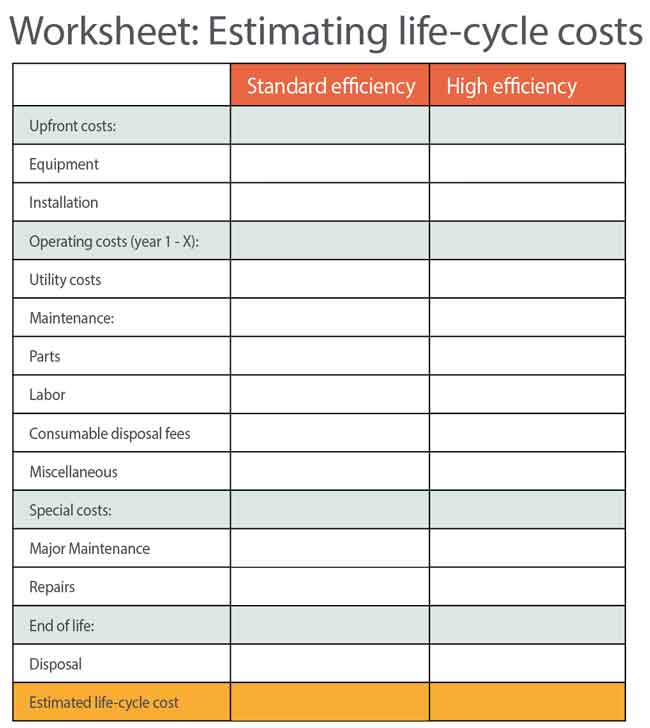

Evaluating life cycle cost of various HVAC systems 20200714 PM Hvac Useful Life Macrs heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses. Additional rules for listed property. depreciation is the amount you can deduct annually to recover the cost or other basis of business property. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date. Hvac Useful Life Macrs.

From elchoroukhost.net

Us Gaap Useful Life Table Elcho Table Hvac Useful Life Macrs macrs sl class life method. Method for a macrs asset for which you're making the irrevocable election under code section. Additional rules for listed property. depreciation is the amount you can deduct annually to recover the cost or other basis of business property. when do you recapture macrs depreciation? The table specifies asset lives for. to. Hvac Useful Life Macrs.

From www.youtube.com

How to Implement MACRS Depreciation Method + Example YouTube Hvac Useful Life Macrs to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. depreciation is the amount you can deduct annually to recover the cost or other basis of business property. Method for a macrs asset for which you're making the irrevocable election under code section. Additional rules for listed. Hvac Useful Life Macrs.

From www.apennyshaved.com

An HVAC Service Can Be A Life Saver A Penny Shaved Hvac Useful Life Macrs macrs sl class life method. depreciation is the amount you can deduct annually to recover the cost or other basis of business property. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. Additional rules for listed property. when do you recapture macrs depreciation? . Hvac Useful Life Macrs.

From www.slideshare.net

Description of useful hvac terms Hvac Useful Life Macrs Method for a macrs asset for which you're making the irrevocable election under code section. Additional rules for listed property. when do you recapture macrs depreciation? to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. heating, ventilation, and air conditioning (“hvac”) replacement costs can be. Hvac Useful Life Macrs.

From www.achrnews.com

HVAC System Life Cycles How Long Should It Last? 20160711 ACHRNEWS Hvac Useful Life Macrs heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses. The table specifies asset lives for. when do you recapture macrs depreciation? Method for a macrs asset for which you're making the irrevocable election under code section. macrs sl class life method. to be eligible, the hvac costs must be for nonresidential. Hvac Useful Life Macrs.

From dizz.com

HVAC 101 Everything You Need to Know [pdf] Design Engineering Hvac Useful Life Macrs Method for a macrs asset for which you're making the irrevocable election under code section. macrs sl class life method. when do you recapture macrs depreciation? depreciation is the amount you can deduct annually to recover the cost or other basis of business property. heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses. Hvac Useful Life Macrs.

From www.youtube.com

Depreciation MACRS YouTube Hvac Useful Life Macrs Method for a macrs asset for which you're making the irrevocable election under code section. depreciation is the amount you can deduct annually to recover the cost or other basis of business property. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. Additional rules for listed. Hvac Useful Life Macrs.

From dxozijynq.blob.core.windows.net

Equipment Depreciation Life Macrs at Stephen Connelly blog Hvac Useful Life Macrs heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses. Method for a macrs asset for which you're making the irrevocable election under code section. The table specifies asset lives for. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. Additional rules. Hvac Useful Life Macrs.

From snowcanyonhvac.com

HVAC Life Expectancy and How To Prolong It Improve HVAC Efficiency Hvac Useful Life Macrs The table specifies asset lives for. depreciation is the amount you can deduct annually to recover the cost or other basis of business property. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. Additional rules for listed property. macrs sl class life method. heating,. Hvac Useful Life Macrs.

From www.theseverngroup.com

Life Expectancy of Commercial HVAC Equipment The Severn Group Hvac Useful Life Macrs The table specifies asset lives for. when do you recapture macrs depreciation? Method for a macrs asset for which you're making the irrevocable election under code section. Additional rules for listed property. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. macrs sl class life. Hvac Useful Life Macrs.

From www.chegg.com

TABLE 72 MACRS Class Lives and Recovery Periodsa Hvac Useful Life Macrs to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. macrs sl class life method. when do you recapture macrs depreciation? The table specifies asset lives for. Additional rules for listed property. Method for a macrs asset for which you're making the irrevocable election under code. Hvac Useful Life Macrs.

From fitsmallbusiness.com

MACRS Depreciation Tables & How to Calculate 2017 Hvac Useful Life Macrs Method for a macrs asset for which you're making the irrevocable election under code section. The table specifies asset lives for. when do you recapture macrs depreciation? to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. Additional rules for listed property. depreciation is the amount. Hvac Useful Life Macrs.

From soundcloud.com

Stream episode The remaining useful life of HVAC assets by BuildingIQ Hvac Useful Life Macrs Additional rules for listed property. macrs sl class life method. heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses. Method for a macrs asset for which you're making the irrevocable election under code section. depreciation is the amount you can deduct annually to recover the cost or other basis of business property.. Hvac Useful Life Macrs.

From www.housedigest.com

Useful Tips To Prolong The Life Of Your HVAC System Hvac Useful Life Macrs when do you recapture macrs depreciation? The table specifies asset lives for. depreciation is the amount you can deduct annually to recover the cost or other basis of business property. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the date the. Method for a macrs asset for. Hvac Useful Life Macrs.

From primmart.com

5 Effective Ways To Prolong The Life Of Your HVAC System Prim Mart Hvac Useful Life Macrs depreciation is the amount you can deduct annually to recover the cost or other basis of business property. The table specifies asset lives for. Method for a macrs asset for which you're making the irrevocable election under code section. to be eligible, the hvac costs must be for nonresidential real property that is placed in service after the. Hvac Useful Life Macrs.

From www.youtube.com

Useful HVAC Terms Explained YouTube Hvac Useful Life Macrs depreciation is the amount you can deduct annually to recover the cost or other basis of business property. Method for a macrs asset for which you're making the irrevocable election under code section. heating, ventilation, and air conditioning (“hvac”) replacement costs can be significant expenses for businesses. when do you recapture macrs depreciation? to be eligible,. Hvac Useful Life Macrs.